I recently dipped my toe into the Metals and Mining waters and walked away with the reinforcement that every industry is susceptible to disruption. There has long been a feeling that non-digital industries are safe from the power of disruption. In a recent piece on a New Economic Paradigm, this topic is explored in greater depth, questioning the long term viability of not just current industry structures – but the economic paradigm itself.

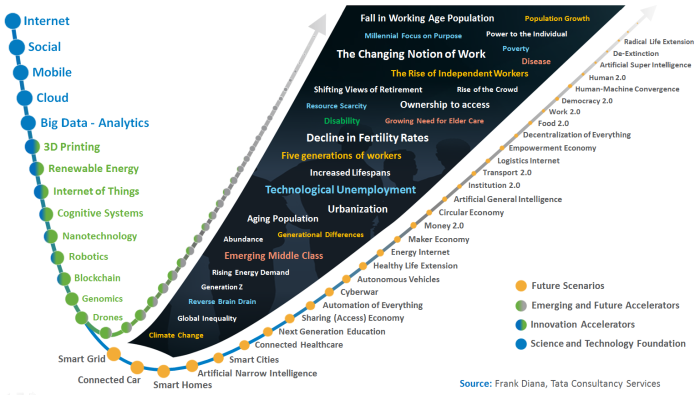

Disruptive scenario analysis should be a critical focus for every business across every industry. In addition, as these scenarios converge, the implications of this convergence to a given industry or industries must be understood. The anchor visual below identifies a number of scenarios to consider. Let’s take a look at disruption in the context of the Metals and Mining industry, as well as some possible industry responses.

Let’s call the first area of impact economic paradigm shifts. Three of our disruptive scenarios above fall into this category: the sharing, maker, and circular economy. I will do a separate piece on the circular economy, but a good primer by Mckinsey can be found here. In a circular economy, the industrial system renews itself by design, shifting material, energy, and labor inputs from disposable to renewable. Products are designed with this in mind, with cycles being circular versus linear. This paradigm shift has big implications for existing business models. Envision the scenario where washing our clothes becomes a service (wash-as-as-service). Rather than purchase a washing machine, we rent it and pay by the wash. The machine is replaced at a predetermined time, and is then either refurbished or disassembled for reuse in another product cycle. What are the implications to Metals and mining companies?

The maker economy promises a similar impact on waste reduction. 3D Printing (an innovation accelerator on our visual) eventually enables a just-in-time versus just-in-case model of production. As the world shifts to this on-demand model, fewer resources are required – and with that – less mining of the earth. In a sharing economy, there is also the potential for reduced consumption. Do we buy fewer cars as we shift from an ownership to access model? Do we lend, rent, or otherwise share things that reduce our retail spending? Does automobile demand per capita shrink as an increasingly urban population shifts to dependable, low-cost public transportation systems?

These impacts drive the need for Metals and Mining companies to participate as part of broader ecosystems. The shift from vertical to horizontal orientation will not spare the Metals and Mining industry. With a wider range of stakeholders in an expanding ecosystem, this shift requires a new way of thinking: from firm-centric value creation and capture to ecosystem-centric. Those companies that maximize shared value will secure the strongest market position.

Other disruptors are likely to impact the Industry as well:

Sustainability

Accountability to higher social and environmental standard is sure to impact the industry. Steel companies for example are developing steel girders that can be disassembled and reused in other buildings, reducing waste and cutting greenhouse gas emissions. As the ability to trace materials used in products emerges, new financing and ownership models arise to incentivize sustainable behavior. In a sustainable world, new business models that affect the Industry will evolve.

In an Energy context, the materials needed to generate new forms of energy are very different. As a greater portion of energy comes from renewable sources (e.g., wind and solar technologies) they require significantly more steel than other energy sources. Other sources like hydrogen fuel cells and nuclear power drive an increased demand for metal catalysts such as zinc and platinum. To survive in this world, Metals and Mining companies need to position for Leadership in a Sustainable World.

Resource Scarcity

We will have 3 billion more consumers by 2025, and two thirds of the global population (5 Billion people) could be middle class by 2030. The scarcity of resources created by this phenomenon and the price changes driven by supply and demand likely drives a search for substitutions. It could also lead to a search for alternative sources of scarce resources (e.g., deep sea and asteroid mining)

Substitutions

Scarcity premiums provide the economic incentive for alternatives. Examples include using recycled materials instead of mined materials, using plastics instead of metal to build appliances, or using biomass instead of uranium to produce energy. Recycling has a number of advantages, as it takes less energy to recycle discarded materials than to extract, process, and refine metals from ore:

- It takes 95% less energy to produce aluminum from recycled materials rather than from bauxite ore

- Recycling copper takes seven times less energy than processing ore

- Recycled steel uses three-and-a-half times less energy

Reduced Consumption

During the 20th Century, per capita resource consumption rose fourfold. By 2050, consumption of natural resources is expected to rise by an additional factor of three. Resource scarcity and a long list of environmental impacts are the likely outcome. With the growing realization that the status-quo is unsustainable, many are calling for a major reduction in materials use. New ways of using materials more intelligently are being explored. By reducing waste and moving towards a circular versus linear model, a few pioneering firms are changing the role of materials in our lives – with implications for the Metals and Mining Industry.

With this as a backdrop, let’s look at the macro-level disruptors facing this industry (scenario analysis), and the possible responses (response analysis).

Disruptors

- Innovations that enable recovery of precious materials or supplanting traditional materials

- Shift from disposability to restoration drives re-generative design and reduced consumption

- Closed loop systems reduce the need for extraction and processing of new resources

- Worldwide adoption of the just-in-time vs. just-in-case model of production reduces consumption

- Shift from subtractive manufacturing to additive manufacturing eliminates waste

- Resources substituted by alternatives enabled by technology (e.g. 3D Printing, Nano-technology)

- Decreased automobile demand due to urbanization and the sharing economy

- Shift in automobile material requirements as experience design replaces safety needs

- Shift to renewable energy drives a shift in the materials required to generate energy

- Sustainability demands drive a need to improve safety, increase productivity, and reduce costs

- Sustainability forces companies to radically re-think their business models

- Resource scarcity drives the need for alternative sources

- Resource scarcity and environmental impacts drive a reduced consumption agenda

- The price tag to extract scarce resources becomes prohibitively expensive

- Economic incentives drive metals consumers to look for alternatives

- The shared economy drives a reduction in manufacturing and consumption

- Increased demand from 3 billion people that join the consumer ranks by 2025

- Increased demand from 5 billion people that join the ranks of the middle class by 2030

- Spiraling prices and unparalleled volatility continue in the future

Possible responses to disruptive scenarios should be identified. In a recent book on innovation and large companies, the authors stress the need for a basket of killer options. These options go through a rapid experimentation and prototyping cycle to identify those responses that should continue to be explored. A response analysis might look like this:

Responses

- Extending the life expectancy of resources by anticipating and planning for future applications

- Creating non-traditional revenue streams as traditional materials are supplanted

- Establishing new and more effective relationships across the ecosystem

- Shifting from linear to circular business models – e.g. renting, leasing, performance

- Re-skilling driven by a shifting set of skills and capabilities

- More actively involved in scrap markets to drive material reuse

- Operating advanced scrap collection and distribution systems

- Deploying higher environmental and social standards

- Maximizing shared ecosystem value to secure the strongest market position

- Including more stakeholders in the expanding Metals & Mining ecosystem

- Maximizing automation technologies across the mining life cycle

- New sources, such as deep sea and asteroids is part of the portfolio

- Miners determine where the risks of decreased demand or substitution loom largest

The common denominator across every disruptive scenario is the growing urgency for scenario analysis and response generation. The historical challenges that traditional companies have with rapid experimentation and prototyping are a growing concern. Not all responses are viable responses, and the days of spending years and millions evaluating alternatives are gone. In my next post, I will look at a process for thinking about this growing need to attack these issues head on.

[…] I recently dipped my toe into the Metals and Mining waters and walked away with the reinforcement that every industry is susceptible to disruption. There has long been a feeling that non-digital in… […]

LikeLike

Agreed, no industry is ‘safe from the disruption’ caused by technological advancement. This is the price of progress that we are to bear. Transitions can be made easier if the workforce is simultaneously trained to contribute to the changes.

LikeLike

While still moving slower than I’d like, CubeSpawn is truly closing in on one solution to merge the maker movement with the circular economy (I prefer the term closed loop} CubeSpawn is a group of standard form factor machines that handle different parts of the industrial manufacturing process – I’m starting with small, benchtop scale machines, but these can bootstrap to larger machines by doubling, run the same open source control and supply chain software at any scale, and rely on a digital repository of full automation files that will request stock or raw materials and produce finished goods, this displaces freight costs out of the products it makes, and populating the repository with recycling processes and local power systems means anyone could own and run one of these systems

LikeLike

Frank, one of our guys recently published an article on innovation in the mining industry that has some interesting counterpoints to your post. Thought you might find it interesting and I would be interested in your opinion on it.

https://www.ausimmbulletin.com/feature/innovation-in-mining/

LikeLiked by 1 person

Dan – thanks for sharing it. I’ll take a look and get back to you with my thoughts

LikeLike

The ultimate disruption of the mining industry from which there is no escape is the increasing automation of recycling. I have watched the waste industry start to change in recent years from a single tier of collectors that buried the waste in holes in the ground into a three-tier business model with collectors and primary separators, secondary separators and finally, recyclers that make new products from the waste.

Less and less manual picking is required for waste separation, so fully automated separation doesn’t stretch the imagination much, even without separation at source. Technology is rapidly evolving that can successfully separate and recycle more and more of the waste stream – probably with much waste being transported to specialist units for particular materials, such as recovery of rare earth metals from electronics, a fourth tier yet to appear. Waste is a random materials stream, with some elements (glass splinters for instance) causing major damage to moving parts, so it would require a modular approach in which replacement of worn-out (possibly sacrificial) parts would be replaced by other robotics – but again, not much of a stretch. These recycling plants would not need humans and would be needed in a considerable volume, so can be made cheaply, perhaps by other automated factories, and so on. Then we would only require raw materials where there were insufficient materials being produced by recycling. As waste volumes rose and fell, unused robotic recycling plants could be mothballed without expensive layoffs. No pension plans, no staff canteens, no sick leave, no air conditioning, no toilet faclilities are required, and specialised environments that are hostile to humans could be easily maintained throughout the processing facility, such as vacuums or inert gases, very cold conditions etc.

I’m not sure what redundant miners would do. Perhaps other forms of manual engineering, but modularisation of robotics threatens those jobs too, and mining can easily be automated too – the only barrier is that currently, robots are more expensive than people in these jobs, a barrier that is overcome by modularisation and mass-production of robotics. The future of employment is in design, research and other jobs that use the supercomputer in our heads for what it is good for, rather than jobs that are best suited to automation.

LikeLiked by 1 person

What a great example of scenario analysis – thank you!

LikeLike

[…] The common denominator across every disruptive scenario is the growing urgency for scenario analysis and response generation. The historical challenges that traditional companies have with rapid experimentation and prototyping are a growing concern. Not all responses are viable responses, and the days of spending years and millions evaluating alternatives are gone. […]

LikeLike

[…] The common denominator across every disruptive scenario is the growing urgency for scenario analysis and response generation. The historical challenges that traditional companies have with rapid experimentation and prototyping are a growing concern. Not all responses are viable responses, and the days of spending years and millions evaluating alternatives are gone. […]

LikeLike

[…] Click here to view original web page at frankdiana.wordpress.com […]

LikeLike

[…] Sourced through Scoop.it from: frankdiana.wordpress.com […]

LikeLike

[…] I recently dipped my toe into the Metals and Mining waters and walked away with the reinforcement that every industry is susceptible to disruption. There has long been a feeling that non-digital in… […]

LikeLike

[…] I recently dipped my toe into the Metals and Mining waters and walked away with the reinforcement that every industry is susceptible to disruption. There has long been a feeling that non-digital in… […]

LikeLike

[…] I recently dipped my toe into the Metals and Mining waters and walked away with the reinforcement that every industry is susceptible to disruption. There has long been a feeling that non-digital in… […]

LikeLike

[…] is likely a radically different world in the next 20 years, is it the right lens? For instance, Is any Industry Safe from Disruption? Through various discussion and dialog, my struggle with this lens intensified. At the core of the […]

LikeLike

[…] is likely a radically different world in the next 20 years, is it the right lens? For instance, Is any Industry Safe from Disruption? Through various discussion and dialog, my struggle with this lens intensified. At the core of the […]

LikeLike

In any manufacturing industry the credo today should be disrupt or prepare to be disrupted!

LikeLike

[…] My take: space represents a fascinating area of focus. From space travel, to mining resources on asteroids, there are a number of scenarios emerging that involve space. One interesting note: a scenario like this one begs the question: Is any Industry Safe From Disruption? […]

LikeLike

[…] Resources: while exploring the topic of disruption, it became apparent that no industry was safe. I explored this in the context of the Metals and Mining industry and found several intersections that shape their future. The Sharing, Maker, and circular economy all contribute to shifts in the industrial system. Astounding advances in science and technology fundamentally alter the resources landscape. Add to this emerging scenarios around asteroid mining and we can see yet another example of multiple building blocks converging. […]

LikeLike